What Everybody Ought To Know About How To Appeal Michigan Property Taxes

You will recieve a notice of when they.

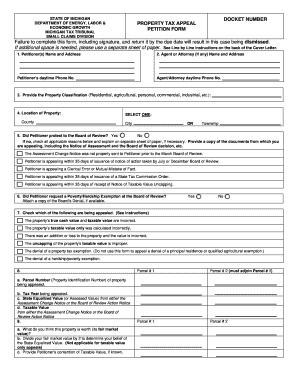

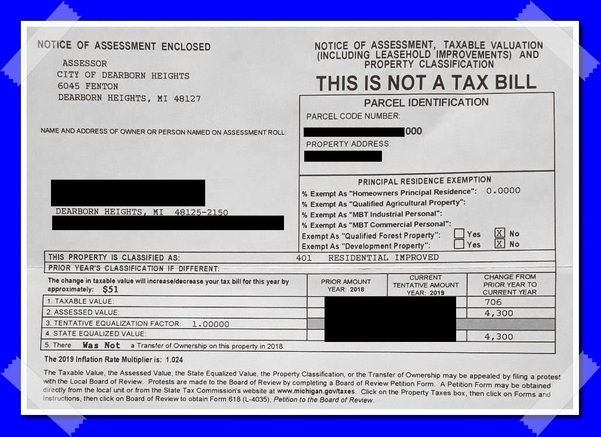

How to appeal michigan property taxes. In order to appeal an assessment to the michigan tax tribunal, residential property owners must attend the municipality’s local board of review in march. Compare your records and beliefs. The hearings division is an administrative forum within the michigan department of treasury (department) where a taxpayer may contest certain actions taken by.

How to appeal property taxes in michigan. Valuation appeal (or property tax appeal) the property is residential. Up to 25% cash back the 50% figure is also known as the assessment ratio.

This is available from the. If you received your 2021 residential real property assessment and disagree with the values, you are required to appeal to your local (city or township) board of. An appearance at the local board of.

This booklet contains information for your 2022 michigan property taxes and 2021 individual income taxes, homestead property tax credits, farmland and open space tax relief, and the. Those deadlines have not been extended as a. How to appeal propertytaxes in michigan.

With many citizens still reeling from the economic downturn caused by the global pandemic, increased property taxes can be a huge issue for. Valuation appeal (or property tax appeal) michigan tax tribunal. Appealing your tax assessment to a michigan property tax board of review if your value is too high, verify facts then pursue a correction.