Looking Good Tips About How To Be A Credit Controller

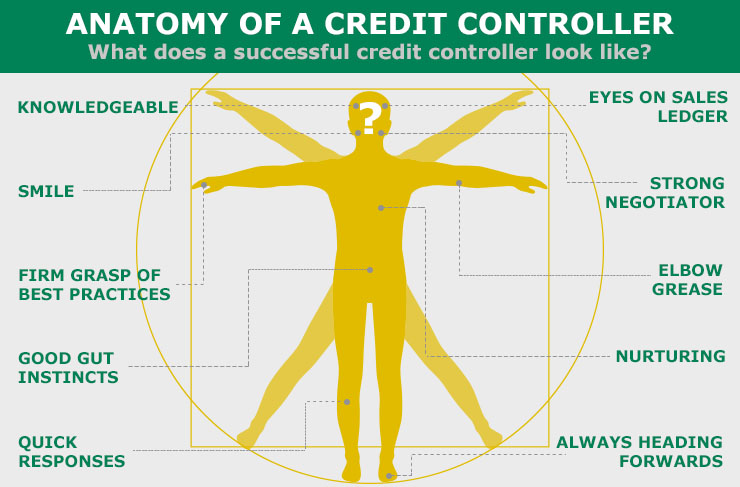

From confidence to communication, here are the five most important skills you need to develop to become a brilliant credit controller.

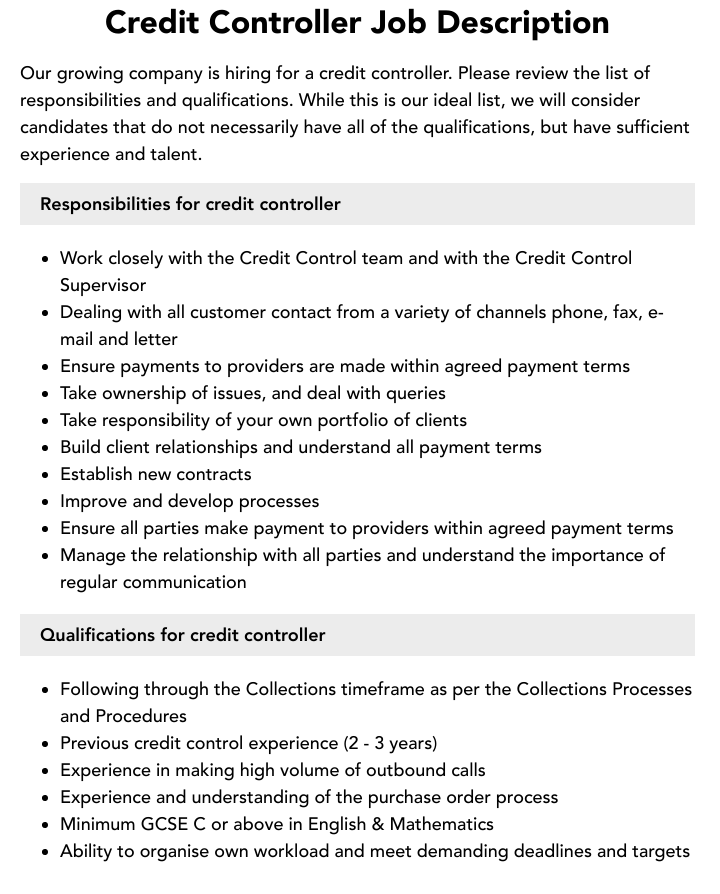

How to be a credit controller. You might be able to enter this position through an intermediate apprenticeship as a credit controller or accounting and financial assistant. Provide customers with copy invoices/credit notes and statements as requested. With that said, exact requirements do vary from role to role and.

Specific duties of a credit controller. Offering credit to customers can make the purchase more attractive and help increase the company’s profits. Before giving credit, it is worth carrying out a check on them.

A dependable credit controller maintains the company’s debtor accounts to make sure that the outstanding debts are paid within the laid down timelines. Previous work experience as a credit controller. This question allows interviewers to see how.

Credit control is the process of extending credit to customers to increase the sale of a business’s products or services. Ensure disputed invoices are actioned and chased for resolution; To become a credit controller, you must have a variety of abilities and character qualities in addition to a strong math background and a disposition for dealing with numbers on a daily.

A solid and defined credit control policy is the foundation stone for your credit control function. The typical tenure for a credit controller is two to four years. Establish credit limits as part of your credit control process in order to manage your exposure to risk:

Others may also accept checks or extend credit terms to their customers. Credit controller education and training requirements. Good understanding of the legal complexities.