Best Of The Best Tips About How To Find Out If Someone Has Life Insurance Policy

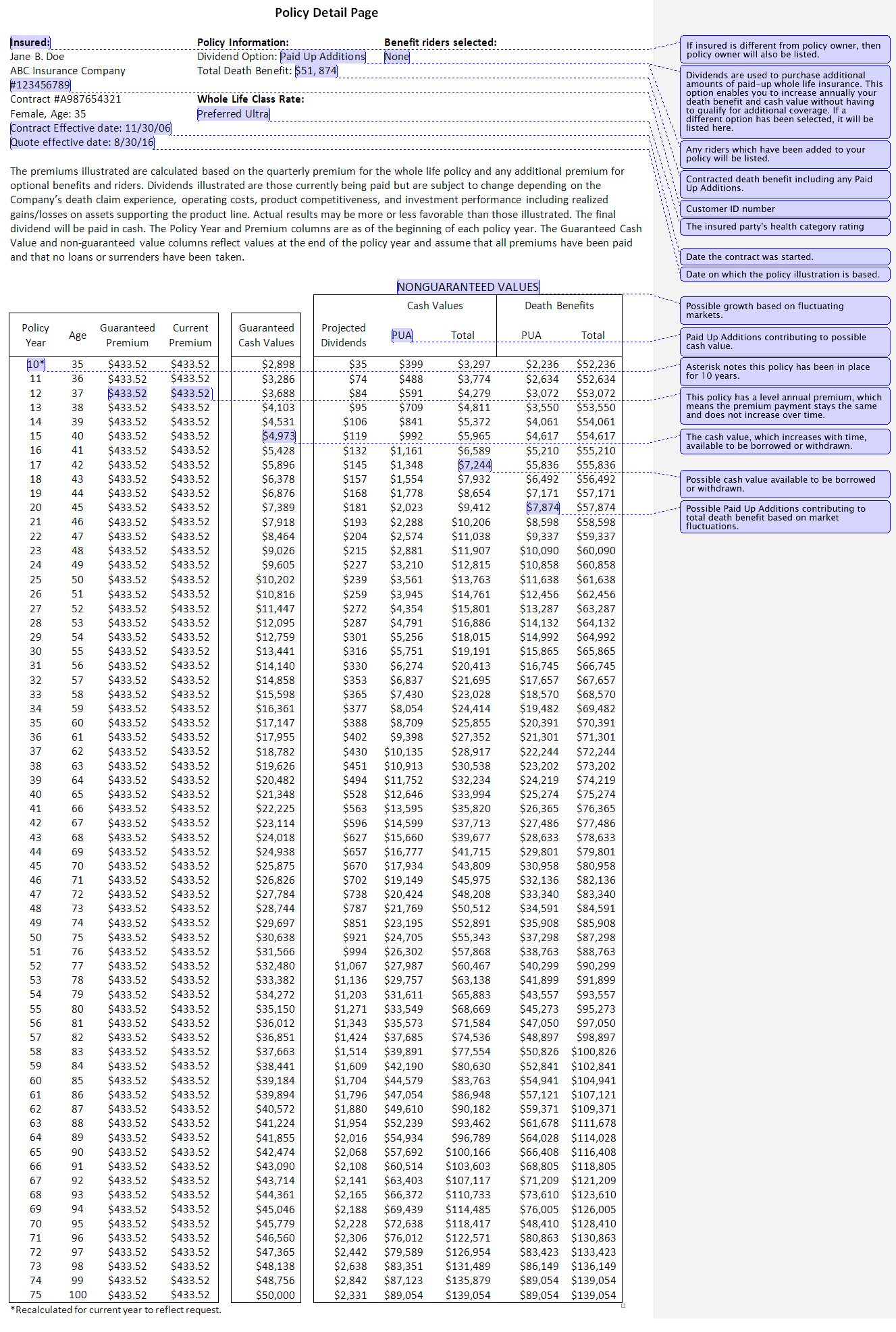

Technically, if you’re indeed the beneficiary of the deceased life insurance benefit, there are 3 main things you need to have to identify yourself as the beneficiary.

How to find out if someone has life insurance policy. They will be able to tell you if you were named as a. Ad see anyone's public record (all states). Several websites offer unclaimed property search capabilities.

You can also check bank statements for premium payments to. Life insurance policy locator service: Access your va life insurance policy online.

There are several things you can do to find out if someone left behind a life insurance policy when he or she died. There are several ways to find someone’s life insurance policy, including: If you have the right reasons to suspect that someone has a life insurance policy on you, then there are options you can explore to discover if your suspicions are correct.

Type any name & search now! The best way to find out if a life insurance policy is valid is to contact the company that issued the policy. Here are some good ones:

The national association of insurance commissioners (naic) website has a free policy locator tool. Another way to find out if someone had life insurance is by talking to the deceased’s family and friends. This policy tends to have a more expensive premium than term life and decreasing life insurance policies.

Here are 11 common ways to find out if someone has life insurance: Look through the deceased’s papers and address books to find out if they had any life insurance policy in their name. If a loved one who has passed away holds a life insurance policy at the time of death, his or her beneficiaries should be paid a death benefit by the insurance company.

/Investopedia-terms-termlife-V3-1e8001745dae43aeaa892c04e25d46b1.png)