Smart Info About How To Handle Debt Collectors

22 minutes agokeep track of every letter, email and phone call you have with debt collectors.

How to handle debt collectors. It is important that you keep track of all communications with the debt collector. Here are 5 ways how to deal with debt collectors when you can’t pay and they keep calling. When you can’t pay the bill, avoiding debt collectors may.

It’s one thing if you get a letter in the mail and you know you’re dealing with a legitimate debt and company. So what do you do when a debt collector calls? If a debt collector contacts you, be sure to get their name, address, and phone number.

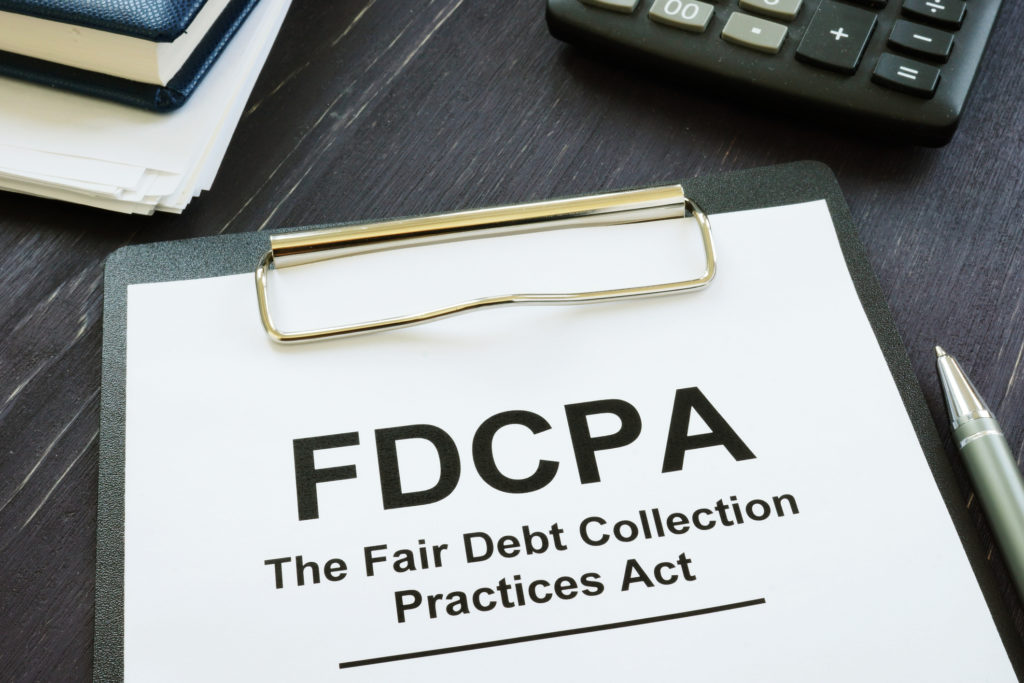

6 ways to deal with debt collectors. With phone calls, emails and texts that you may be receiving. Under federal law, you have 30 days after a debt collector calls to.

Getty images.if you've ever dealt with a debt collector,. As soon as you start communication with the debt collector, you need to start making token payments immediately. How to handle debt collectors.

When dealing with a debt collector on an old debt, don’t admit orally or in writing that you owe the debt or say anything that might restart an expired statute of limitations. Review the debt validation letter carefully and make sure the collector owns the debt. Ask for the proper paperwork.

We call them ‘token payments’ because it should only be based on. Debt collectors cannot lie to you, threaten you, or harass you. How to handle debt collectors apply for a personal loan today.