Great Info About How To Avoid Death Tax

Zimmelman says you can reduce the size of your taxable.

How to avoid death tax. Currently, any assets you transfer upon your death that go past the. A 10% penalty may not sound like much, but combined with taxes, it can significantly cut into your net withdrawal amount. You can then start giving money or other assets to your children as a way of reducing your taxable estate when you die.

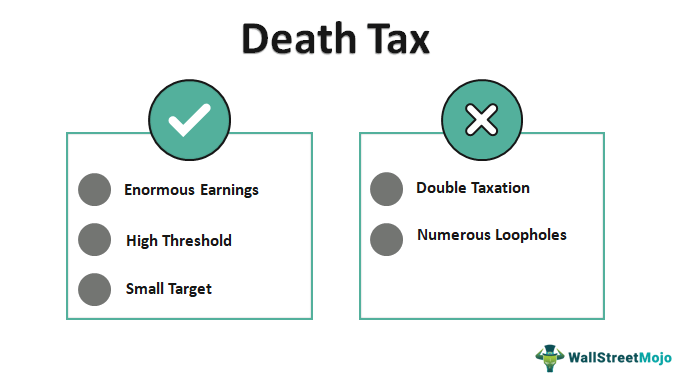

10 ways to reduce or avoid estate taxes 10 ways to avoid or minimize the federal estate tax. Set up an irrevocable life insurance trust. Using irrevocable life insurance trusts, known as ilits, we have the ability to take the death benefits of your life insurance policies out of your taxable estate.

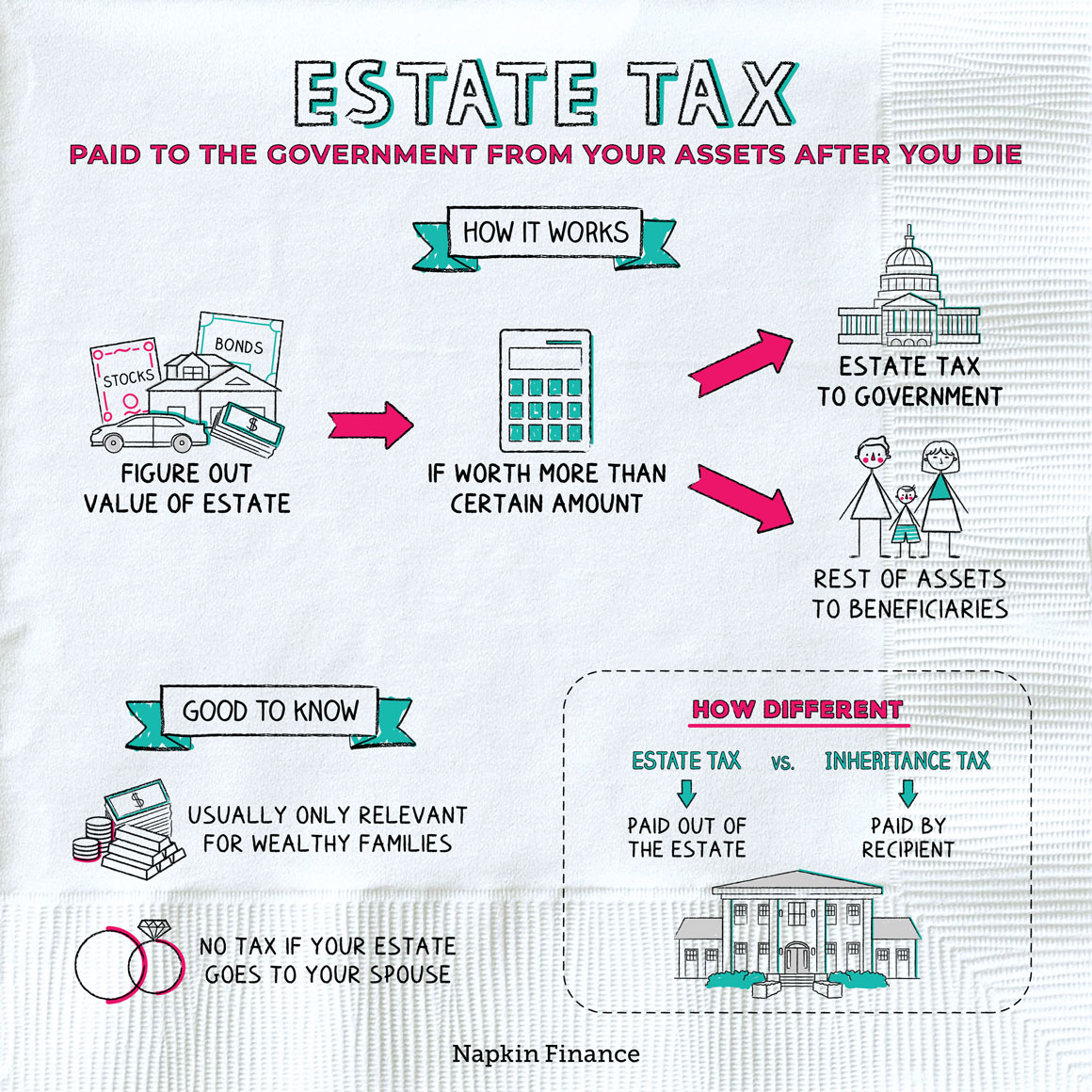

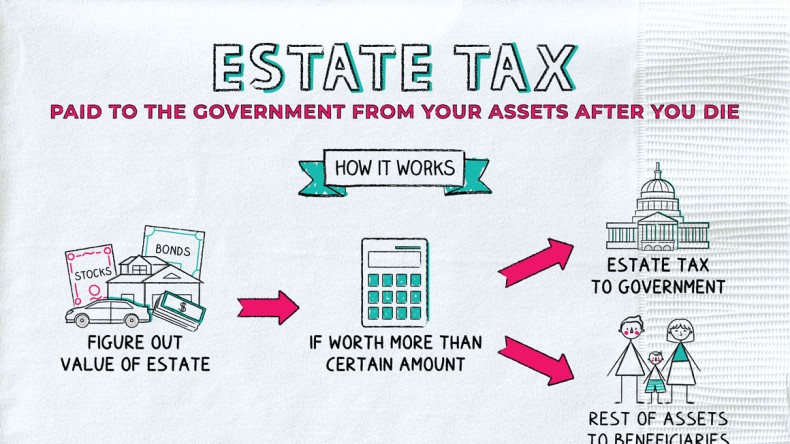

Taxes imposed by the federal and/or state government on someone's estate upon their death. Make sure you keep below the inheritance tax threshold. To do that, you need to set up an irrevocable trust.

That’s because federal tax law allows estates to exclude a certain amount in a tax year up to a certain. One way to get around the estate tax is to hand off portions of your wealth to your family members through gifts. One way to avoid federal estate taxes is by leaving your assets to a surviving spouse.

Anyone can gift up to $15,000 per beneficiary in 2020 without having to pay any gift tax (which is combined with the estate tax). Estates can limit taxes (and in some cases avoid taxation) in one key. Ways to avoid paying death taxes.

The best way to avoid the ‘death tax’ on bequeathed superannuation funds is to withdraw the entire balance before you die. Buy a payable on death (pod) life insurance policy. Depending on state law, probate will generally open 30 to 90 days after the date of death.