Spectacular Info About How To Get Overdraft Fees Back

How to get an overdraft fee refund prepare your personal information.

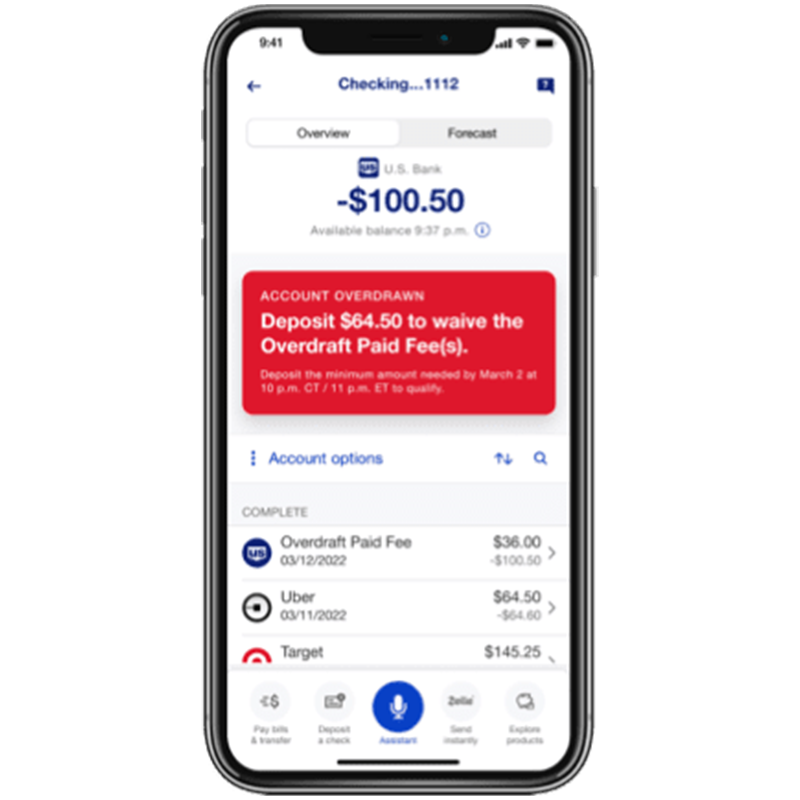

How to get overdraft fees back. Overdraft fees are typically around $35 per transaction, and can quickly add up if you have multiple overdrafts in a single day. You can also get an overdraft fee refund if you replace the overdrawn funds within one business day. Overdraft fees are charged by most financial institutions when a customer’s account balance falls below zero due to a negative check or ach transfer.

While some financial institutions have eliminated or reduced. Do overdraft fees get paid back? Huntington bank is another bank that can help you save on overdraft fees.

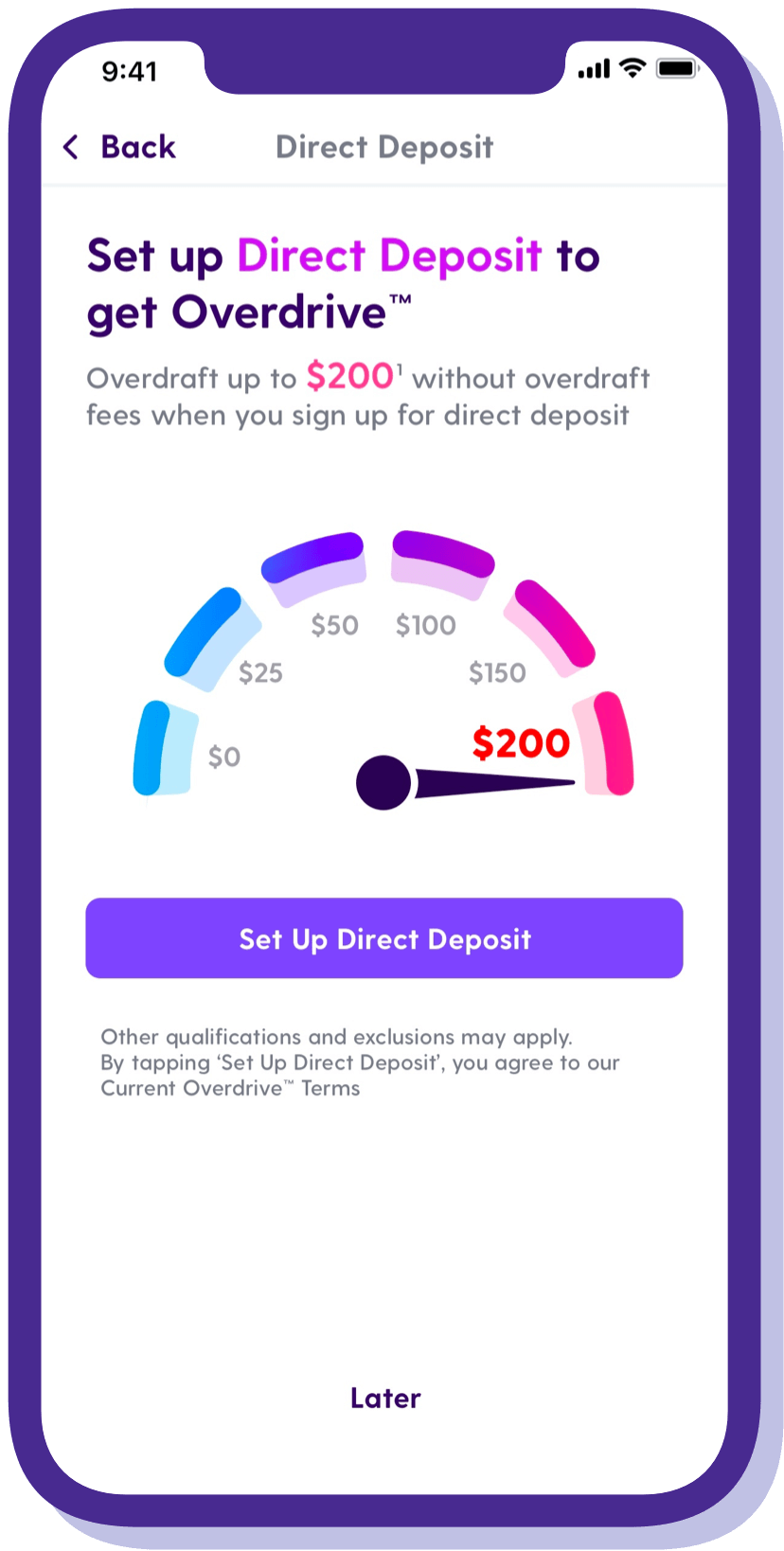

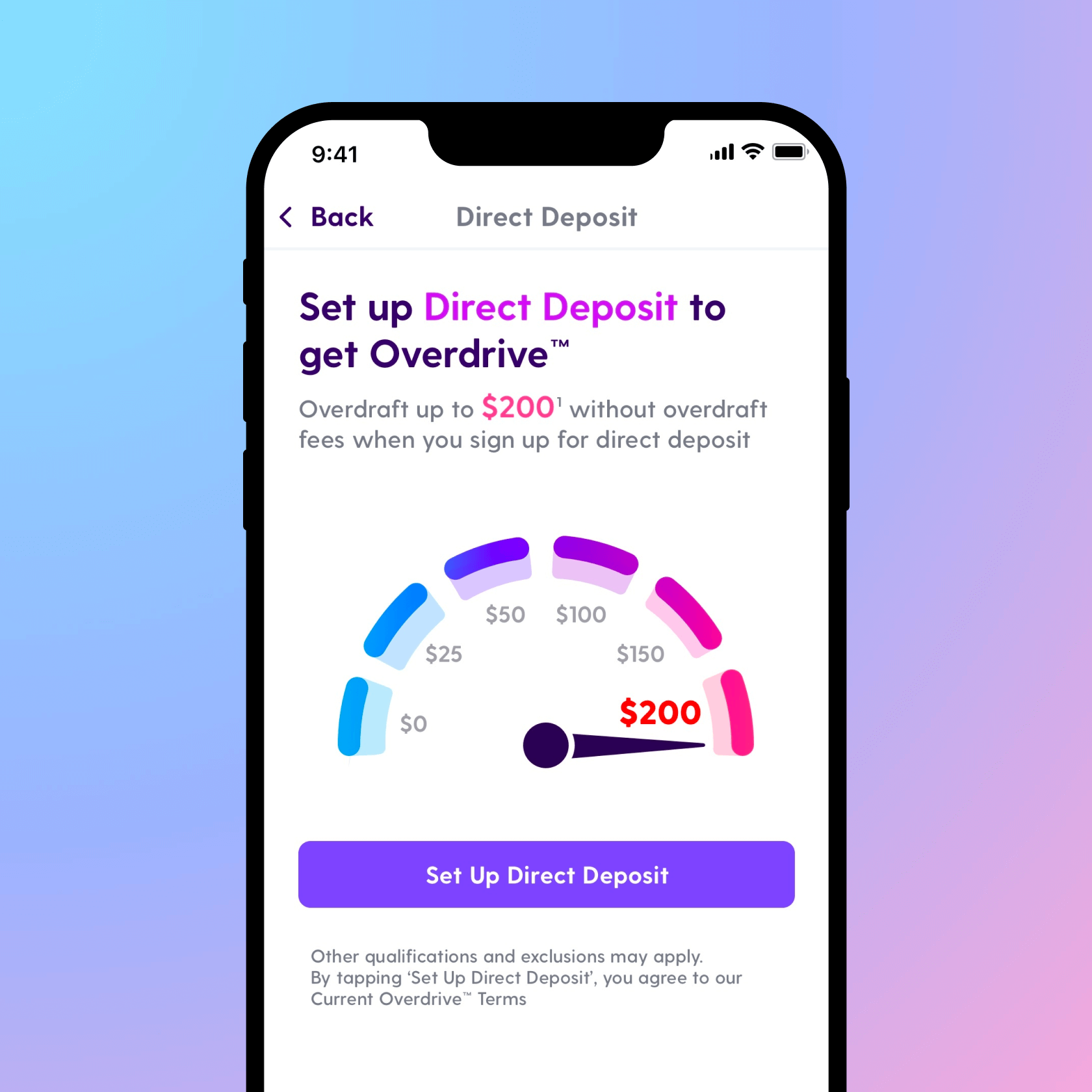

Overdraft fee refunds one of the most common types of bank fee refunds, harvest automatically negotiates overdraft fees with ease or can show you how to get overdraft fees refunded on. While the amount of overdraft fees you need to pay varies from bank to bank, the typical overdraft fee will cost you about this. How to get overdraft fees refunded as soon as you see an overdraft fee on your account, talk to a customer representative from your financial institution to see if the fee might.

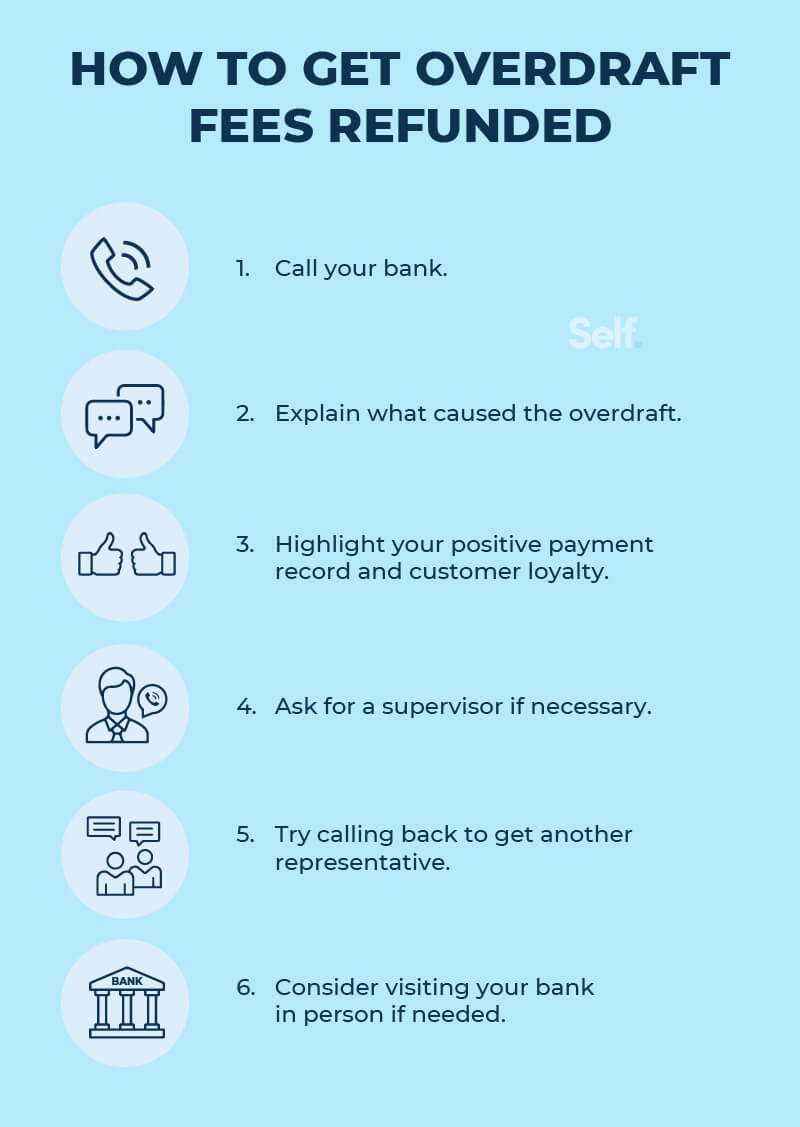

How to get an overdraft fee refunded. The typical cost of an overdraft in the year. There are a variety of ways you could try to get overdraft fees refunded, such as:

Follow this guide and see if you can get that money back from your bank, despite drawing too much from your account. This perk is available for all chase accounts except for “chase secure. Get in contact with a chase representative.

If you're wondering how to get overdraft fees refunded, the answer is simple. The good news is you may be able to get a refund if. Call the bank's customer service representative or manager and politely ask to refund the fees.

/images/2021/09/09/smiling-woman-using-debit-card.jpeg)